Real Estate Investment Funds: A Complete Guide

In recent years, real estate investment funds (REITs) have grown in popularity. More and more people are becoming interested in this type of investment fund, but what exactly is it?

Today, we’ll discuss what real estate investment funds are, how they work, and their benefits. So, if you’re considering investing in real estate but aren’t sure where to start, keep reading!

What are Real Estate Investment Funds?

Real estate investment funds are pools of money that are used to invest in real estate. The money for these funds comes from various sources, including individuals, institutions, and corporations. REITs can be used to invest in various property types, including office buildings, shopping centers, apartments, and hotels.

When you invest in a real estate investment fund, you become a shareholder where your money is used to purchase or finance income-producing properties.

How Do Real Estate Investment Funds Work?

Real estate investment funds typically operate in one of two ways. The first way is through the purchase of existing properties. In this case, the fund will use the money it has raised to buy property outright.

The second way is through the development of new properties. In this case, the fund will provide financing for the development of new real estate projects. The return on investment for real estate investment funds comes from various sources, including rental income, capital appreciation, and tax benefits.

What are the Benefits of Investing in Real Estate Investment Funds?

There are several benefits associated with investing in real estate investment funds. One of the most significant benefits is that it provides investors with a way to diversify their portfolios.

REITs offer exposure to real estate without the need for direct property ownership. This can be especially helpful for small investors who might not have the resources to purchase the property outright. In addition, real estate investment funds can offer a steadier return than other types of investments.

Are Real Estate Investment Funds Right for Your Portfolio?

Now that you know more about real estate investment funds, it’s time to decide if they suit your portfolio. If you’re looking for a way to diversify your investments and get exposure to the real estate market, real estate investment funds are a great option to consider.

They offer high dividend yields and relatively low risk, making them an excellent option for income-seeking investors. However, it’s important to remember that all investments come with some risk. Before diving right in, research the options available and speak with a financial advisor.

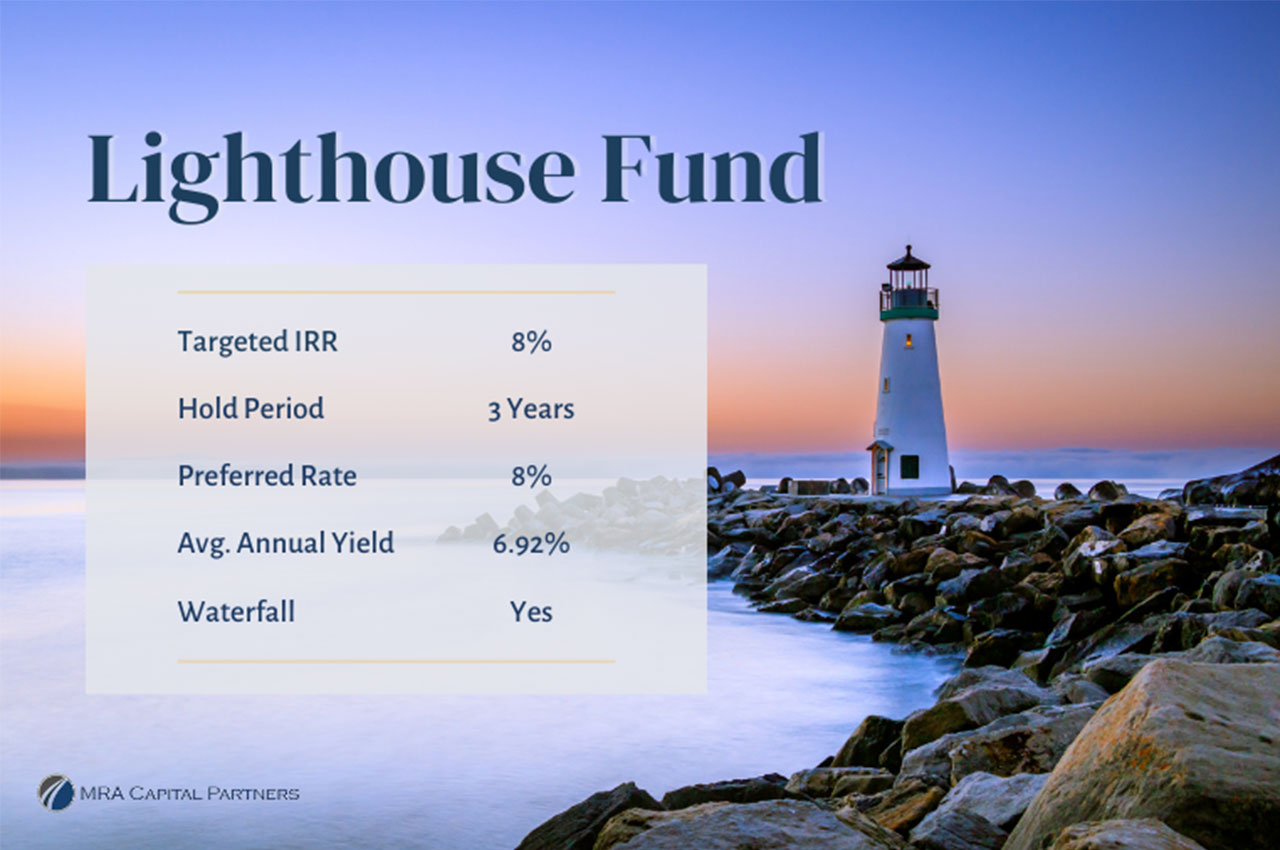

Finding Opportunity. Delivering Results

MRA Capital Partners offers real estate investment strategies focused on maximizing the internal rate of return through favorable deal structures and the pursuit of non-correlated investment returns. Learn more about our investment strategies by visiting us online. Also, sign up to join MRA Capital Partners’ preferred investor network to learn more about our upcoming unique investment opportunities.